Statistical resources say that more than 52% of American portable gadget users will provide peer-to-peer (P2P) transactions by the 2022 year-end. Isn’t this opportunity stunning both for users and developers?

This post will discuss more how to implement secure and quick P2P payments into your commercial app, what your benefits from such an implementation would be, and more essentials.

P2P Payment Application: The Essence and Operational Principles

For a deeper understanding of the subject, let’s discover the essence of the person-to-person (P2P) payment notion. This is the way of making online transactions between holders of credit cards and banks through e-commerce mobile apps or websites.

This payment method can be performed via several clicks: the customer operates through their app private account, finding other people’s contact information to send funds. The transaction takes from several minutes to a few days, and the money is available after the payment is completed.

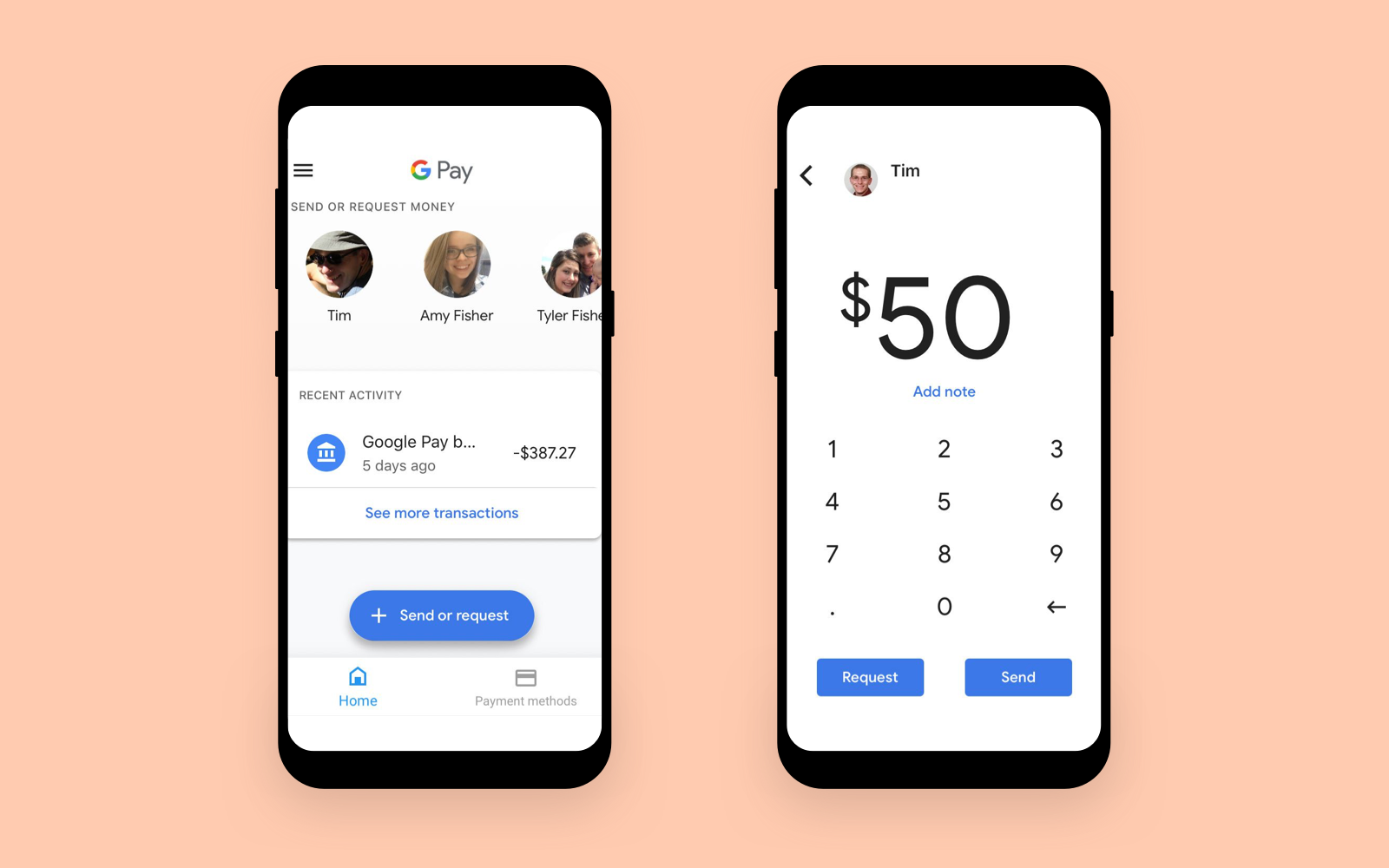

The P2P payment solution interface

Before starting a project development, you should decide what type of P2P application you need to implement.

- Social media have their own P2P transaction systems, and due to them, you can send money to the person you need straight through a messenger.

- Banking apps allow users to transfer money from card to card with minimal commission fees.

- Native applications, such as Google/Apple Pay, are the built-in OS functionality.

- Independent apps are mostly e-wallets with built-in Visa or Mastercard support.

While creating a P2P software, you’d better have to select between a banking and an independent solution.

Reasons to Develop a P2P Payment App

P2P technology has tremendously risen in its popularity these days. So, in case you need a proprietary solution for quick and protected money transfers from your large financial establishment, you should pay attention to creating a P2P app.

These are some more reasons for this app development:

- The anonymity of money transactions

- Possibility to work with crypto

- Absence of intermediaries in fund transfers

- Safety and security of current P2P systems

- Transparency of the processes

P2P Payment Solution: Basic Functionality to Implement

As the P2P app functionality may vary due to the tasks to be completed and app types, we will review only the feature set required for the P2P solution’s MVP development.

- Unique passwords and a customer ID are necessary to protect your app from penetration and data stealing.

- A private electronic wallet will help you efficiently make transactions.

- Bills and invoices management make financial reporting easier for accountants and even people unfamiliar with running finances.

- Money requests/transfer is vital to allow users to make financial operations through your app.

- Transactions history helps users analyze and monitor the accomplished money expenditures for a certain period.

- Push notifications will inform you about any new events that will be in the near time.

After developing an app with the basic functionality, you can allow the early customers to use it. Gather feedback, and analyze the collected information. If everything’s OK, you can add advanced functionality to make your app comfortable and distinctive.

Vital Steps to Build a P2P Application

It’s difficult to create a secure and safe peer-to-peer payment system. The steps you should pass through are described below.

- First off, select the solution type (off-the-shelf/customized) and mobile platform you’ll use (iOS/Android/both variants).

- Prepare and implement a functionality list considering MVP and advanced features.

- Solve the protection issues, adding as many security layers as needed.

- Care about an intuitive and customer-friendly app design.

- Conduct tests to check whether the app is stable and correct working.

None of these steps should be overlooked or skipped, as they are all vital.

The Legal Compliance of FinTech Apps

Regulatory rules and standards should be used by all P2P digital payment apps. These standards are complex but also unique to each location. The United States, for example, has at least eight federal regulatory organizations with specific mandates. Furthermore, each state has its own set of financial rules and laws that you must follow to avoid legal problems.

What else to take into account developing a P2P app?

Summing Up

Building a safe and secure P2P app is quite a complex and challenging task. It needs assistance from a skilled IT vendor having profound expertise in Fintech solutions development. The experts will explain to you all the pitfalls of your project and possible ways to avoid them and help you build a highly-protected and profitable app that will be competitive and sustainable on the market.

Average Rating